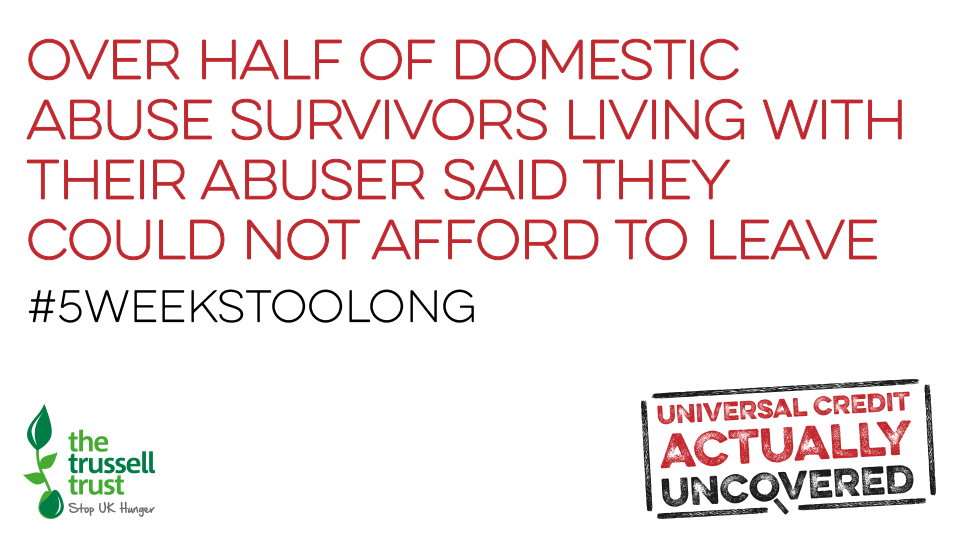

Elaine is a welfare worker supporting survivors in a Women’s Aid member service. Women’s Aid supports the Trussell Trust’s #5WeeksTooLong campaign to end the wait for a first Universal Credit payment.

For survivors of domestic abuse, life is inevitably balanced on a knife’s edge. In our service we constantly adjust the ways we work to ensure those we support are helped as much as possible.

We would be doing thousands of women and children a disservice if we did not make it absolutely clear how systemic changes and problems with those new systems can affect those we work with, already facing precariously dangerous and stressful situations.

In May, more than 120 MPs called for an independent inquiry into the way the family courts in England and Wales treat survivors of rape and domestic abuse and their children.

Prime Minister Theresa May responded by saying the family court system should never be used to coerce or to re-victimise those who have been abused.

Unfortunately, what we are witnessing are life threatening situations involving domestic abuse further exacerbated by issues with the Government’s new benefits system. The lengthy period of time between making a Universal Credit claim and receiving the benefit impacts not only on women’s ability to support themselves and their children, but also on the legal process they are often going through when escaping domestic abuse.

Most of our residents will need a solicitor through Legal Aid. Legal Aid is a means tested benefit, and applications to get it require a benefit award letter dated within the last four weeks. Let’s say a resident moves in to our refuge, we claim Universal Credit – and two weeks later she gets a letter from her abuser’s solicitor about child contact, with a court date in two weeks’ time.

As a claim for Universal Credit takes at least five weeks, we don’t yet have the required evidence for Legal Aid. The resident has to attend court with no representation. We support her, but we are not allowed to speak on her behalf. Due to the time that Legal Aid applications take to process, she may have to attend court without representation again, even after her claim goes through.

This creates a nightmare situation for survivors, who, having taken the terrifying step of escaping their abuser, are then expected to fight for their children’s safety alone in the family courts.

This is so scary for the women we work with – and it allows continued abuse by the perpetrator. Child contact is a common way for a perpetrator to continue to try and abuse and control women, and in these cases it is working for him. It has caused and is causing so much worry and concern, and it has a really detrimental impact on women’s recovery and mental health.

We have tried several different strategies to help those we are working with, but we are feeling increasingly disheartened that the system does not recognise the dangerous and distressing situations that survivors and their children are being put in.

We have tried requesting locally if judges and magistrates will allow Women’s Aid staff to talk on behalf of residents but we have been told no.

I have also contacted the local Universal Credit team at the Department of Work and Pensions (DWP) to see if they will write a letter once Universal Credit has been awarded so we can use it to claim Legal Aid, rather than waiting weeks for the first statement, but have got nowhere with this as yet.

I have asked solicitors to work for free, but again hit a dead end. This is happening more and more due to everyone going over to Universal Credit and is not acceptable. As someone supporting victims I am starting to feel hopeless as all avenues I go down seem to be dead ends.

We have mums and children with us at the moment who are currently on the old benefits system. They will be moving out to suitable housing soon but they will have to claim Universal Credit due to their change in circumstances.

The problem we now have is families moving from our furnished refuge accommodation to an empty house with only Child Benefit as their income for five weeks as they wait for their first payment to come through. We will continue to support the family as best we can, but if they are on meters for utilities, if they need to use buses, how will they cope?

As we are working with the family we are able to intervene, but what if the family has no one, what do they do then?

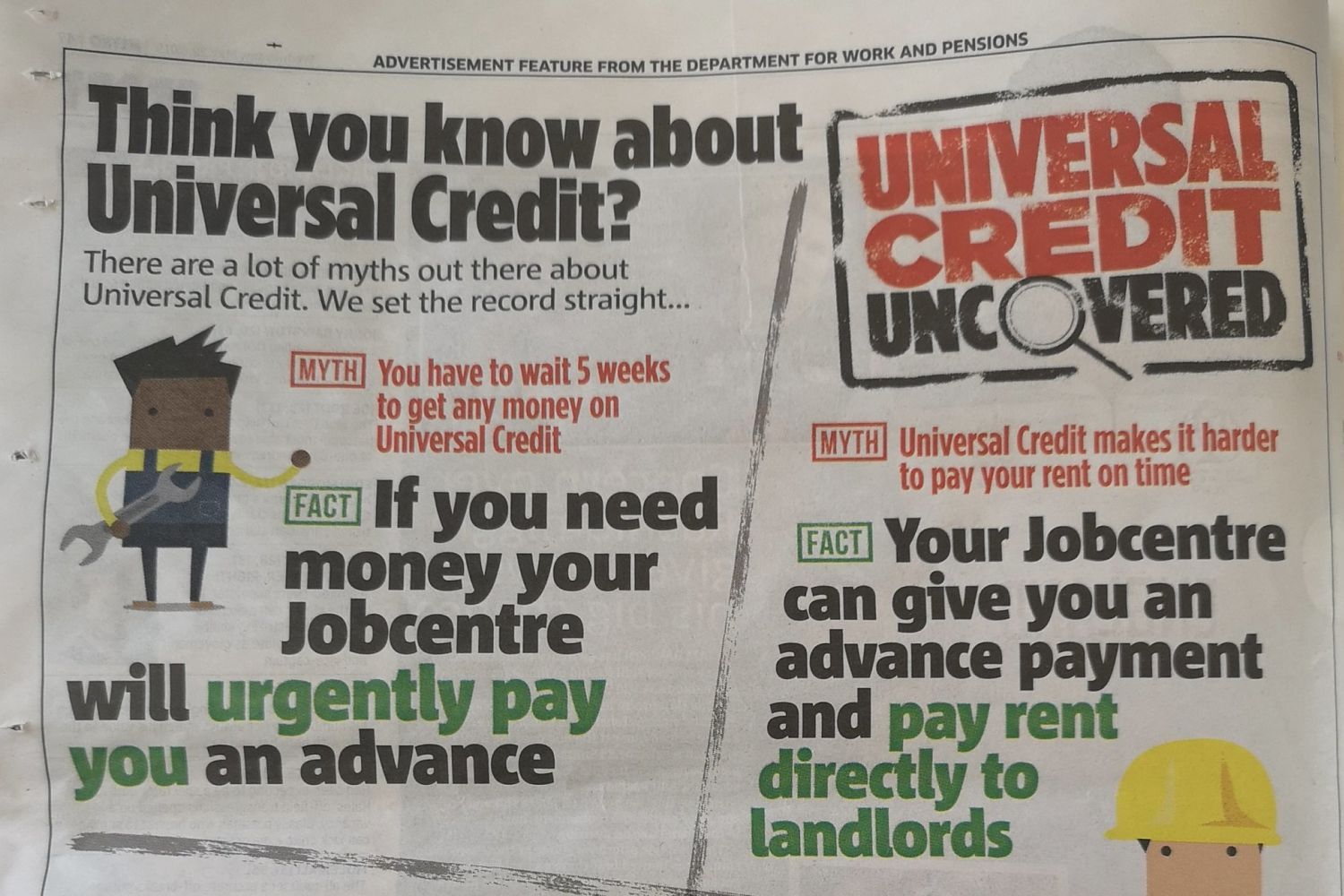

In the short-term, DWP should replace advances with grants, at a minimum for those who are experiencing hardship. It should also be possible to obtain proof of a Universal Credit claim being made, that will be accepted in order to access Legal Aid. In the longer term, there are a number of options to bring forward the first Universal Credit payment, like backdating the first assessment period.

Read more