A blog post by

Sumi Rabindrakumar

Head of Policy & Research

Look closely, and there was a rare glimpse of continuity amongst the political upheaval of the past few days. In a break from the recent past, the Department for Work and Pensions managed to hold onto its Secretary of State as the new Prime Minister formed his Cabinet.

This presents a real opportunity for the future of our benefits system. We have a new Prime Minister who, on the campaign trail, declared that “the poorest come first” in his tax and spend priorities. We also have a Work and Pensions Secretary of State who has declared her commitment to making our new benefits system, Universal Credit, “work for everyone”.

Any vision for our future must include systems which protect us from hardship. Key to this will be Universal Credit, yet we know that problems with its implementation and design are still pulling people into hardship and debt.

The most urgent issue to address is the five week (minimum) wait for a first payment. The Trussell Trust has found a steadily increasing share of referrals due to benefit delays is driven by Universal Credit: the problem has not gone away. That’s why food banks across the country, a range of respected partners from across the charity and housing sectors, and around 15,000 public campaigners – many with direct experience of Universal Credit – have already joined together to call for change.

Encouragingly, there are emerging signs that the Secretary of State seems to agree. Amber Rudd has stated she wants people to get their payments sooner. When quizzed by the cross-party Work and Pensions Select Committee, it was positive to hear some of the work being done to review the waiting period.

But the fact remains that the wait persists.

Much has been made of future improvements such as further run-ons of DWP legacy benefits to shorten the wait. But this won’t be seen for another year (July 2020), doesn’t help people not receiving DWP benefits before moving onto UC and is a short-term fix – once legacy benefits end, there will be no further support.

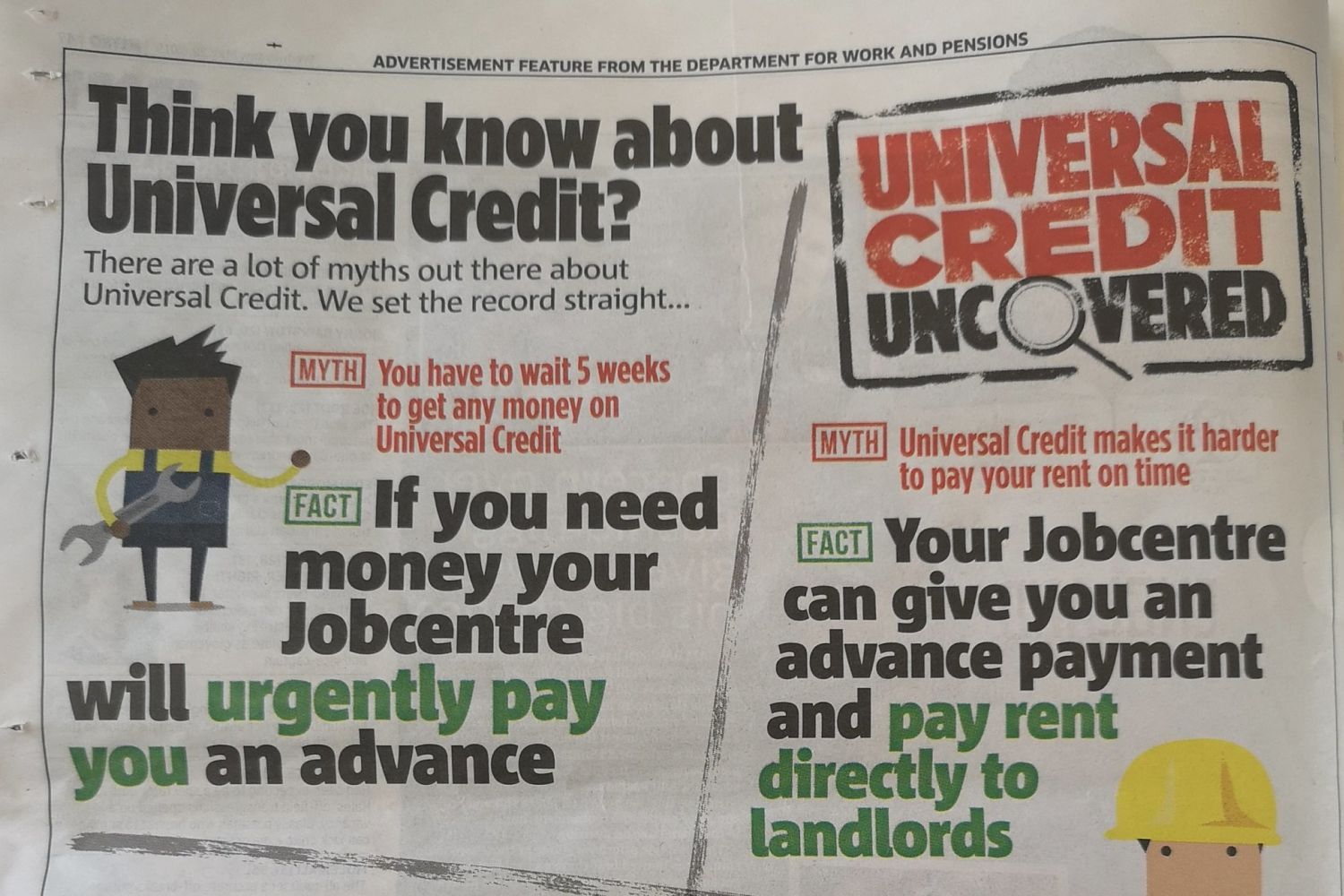

This once again leaves Advance Payments – effectively loans – as the only way to bridge the five week gap in income. It’s a policy that looks on increasingly shaky ground, with clear evidence of the hardship that repayments create for households already under strain. It can’t be right that the only alternative to having no income is to take on a debt.

In uncertain times, it’s difficult to say what will happen next on Universal Credit. But what is clear is that after months of people and organisations joining together and building pressure, there is some movement.

And with a raft of possible spending decisions on the horizon – whether it’s a 2019 Budget, emergency budget, future Spending Review, or general election – there are opportunities to get the investment needed to translate positive words into action.

The new Prime Minister has promised the “beginning of a new golden age”. Any new vision for our nation must include tackling the issues which pull so many of our families into poverty – a benefit system that is fit for purpose, work that is fair and pays and affordable living costs. Without this, people will continue to struggle to put food on the table and cover the rent.

Too often leaders have promised but failed to deliver. With the nation at a crossroads, now is the time for action; the five week wait for Universal Credit is a good place to start.

We know we won’t see change without continuing to build pressure. That’s why we want you to add your voice to tell our new Government that the Universal Credit wait is #5WeeksTooLong.

Read more