By Anna Hughes, Policy Officer

The benefits system, Universal Credit, was introduced in 2013 with the intention to help people on the lowest income in the UK. As food and energy prices soar, it is now vital that Universal Credit is increased with the cost of living, to prevent more people from being pushed towards food banks.

However in March, the Chancellor, Rishi Sunak, was widely criticised for failing to utilise Universal Credit in his response to the cost of living crisis in his Spring Statement.

So, what exactly is Universal Credit? What are the problems with it? And what changes are we calling for the Chancellor to make to ensure the system gives people enough to afford the essentials?

-

Universal Credit was set up to simplify social security

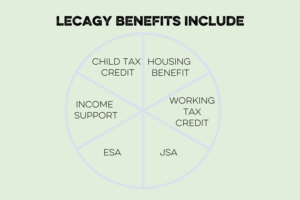

It is now the main benefit for anyone of working age who has a low income, whether in paid work or not. It rolls six ‘legacy’ benefits into one and was set up with the promise that it would simplify the social security system.

In January 2022 there were over 5.6 million people on Universal Credit across the UK.

Universal Credit was intended to be a way for the government to create a welfare system that provided “people with the confidence and security to play a full part in society”.

Unfortunately, by design – through its in-built rules and cuts – Universal Credit is now a benefit that fails to meet these aims.

-

Universal Credit is currently failing to provide people with enough to afford the essentials

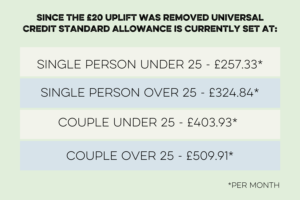

The standard allowance is an element of Universal Credit that is available for all claimants. It’s intended to cover daily living costs for working age adults (excluding housing, children, disability).

These are at the lowest levels in 30 years and aren’t protecting people from destitution, meaning they are unable to afford the essentials we all need to eat, stay warm and dry and keep clean.

As living costs soar, low benefit rates are fast becoming an emergency. Our new YouGov polling found this winter, more than half (56%) of claimants have gone without one of the absolute essentials, and two in five (40%) have been forced into debt. More people are likely to be pushed into this position if the government fails to act.

-

The Universal Credit debt trap

The experience of Universal Credit is made even worse by design features which push people into debt:

- There is a five week waiting period for a first payment, which forces many people to take on debt to cover essential or unexpected costs, at the very start of their claim. The government denies that there is a ‘five week wait’ because all claimants have the option to take out an interest-free loan, the ‘advance payment’. But this loan causes further hardship, as it’s paid back from future Universal Credit payments, reducing the amount people have to live on until the debt is repaid, which could take months.

- Universal Credit rules mean benefits are deducted when people are behind on bills, regardless of whether it is affordable or not. People are often in debt through no fault of their own – for example, the five week wait or historic overpayments due to government mistakes. This would not happen in the private sector, where you would first be able to check if repayments were affordable before being forced to pay.

- The amount of Universal Credit received can be reduced even further by welfare reform policies such as the two-child limit and benefit cap. With benefit levels already set on the threshold of destitution any cap or deduction places families at risk of serious hardship.

We urgently need to reform the design of Universal Credit to make sure it is not pushing people into debt. That should involve changes to the five week wait and advance payments, and introducing repayment affordability assessments.

-

Missed opportunities in the Spring Statement

Political choices got us here – but investment and reform of Universal Credit can play a crucial role in ending the need for food banks. Indeed, the government’s own data showed recently that severe food insecurity (a good indicator of who is facing hunger in the UK) fell most for households claiming Universal Credit in 2020/21, when the £20 uplift was in place.

Yet in his Spring Statement, the Chancellor failed to utilise Universal Credit in responding to the cost of living crisis.

This risks repeating the mistakes of the past – included the cuts and freezes to benefits which left benefits at their lowest level in 30 years before the cost of living crisis hit.

-

Nobody should be left behind

People on legacy benefits have unfairly missed out on vital support during the pandemic and must not be forgotten in any response to the cost of living crisis.

The legacy benefits that existed before Universal Credit are being phased out, but approximately 3 million people still rely on this support, including many who are ill or disabled. Like Universal Credit, legacy benefits have failed to keep pace with the real cost of living. The government also chose not to include this group in the £20 uplift and so they endured the pandemic without any additional support – leaving many people facing serious hardship.

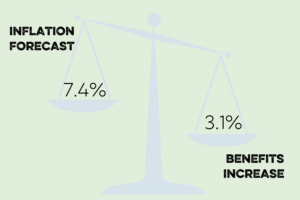

We are asking that people on legacy benefits are not left out again, and that all benefits should be increased by the forecast rate of inflation of at least 7%, not the 3.1% currently planned.

What are we calling for?

The government must increase benefits to reflect the real cost of living. Looking to the future, the UK government must work with people who have lived experience of Universal Credit and develop a plan to ensure everyone can afford the essentials. This should include reforming the design of Universal Credit so that it pulls people out of, rather than pushes people into, destitution and debt, and delivering a new settlement of integrated local crisis support, backed by long-term funding, to empower communities to help people cover unexpected costs. To find out more read our report ‘The True Cost of Living’.

The Chancellor must stick to his word:

‘Everyone should be able to afford the essentials, and we are committed to ensuring that is the case’.

Rishi Sunak, Chancellor, September 2021

If you, or someone you know needs help or information about how to get support, please visit Get Help.