- One in six people who receive Universal Credit needed to visit a food bank at least once since the start of December, according to new research

- Almost 2m people were currently going without food, while others were living in cold conditions as they couldn’t afford to power and heat their homes

- The charity is calling on UK government to urgently bring benefit levels in line with the rate of inflation as a bare minimum this Spring Statement to help prevent more people being forced into debt and to food banks

The Trussell Trust says new research has revealed the true and devastating consequences of the current cost of living crisis, with hundreds of thousands of families across the country struggling to get by.

A new online YouGov poll of people claiming Universal Credit shows two in five (40%) Brits receiving Universal Credit have been forced into debt this winter just to eat and pay bills.

One in six people surveyed (17%) needed to visit a food bank at least once since the start of December.

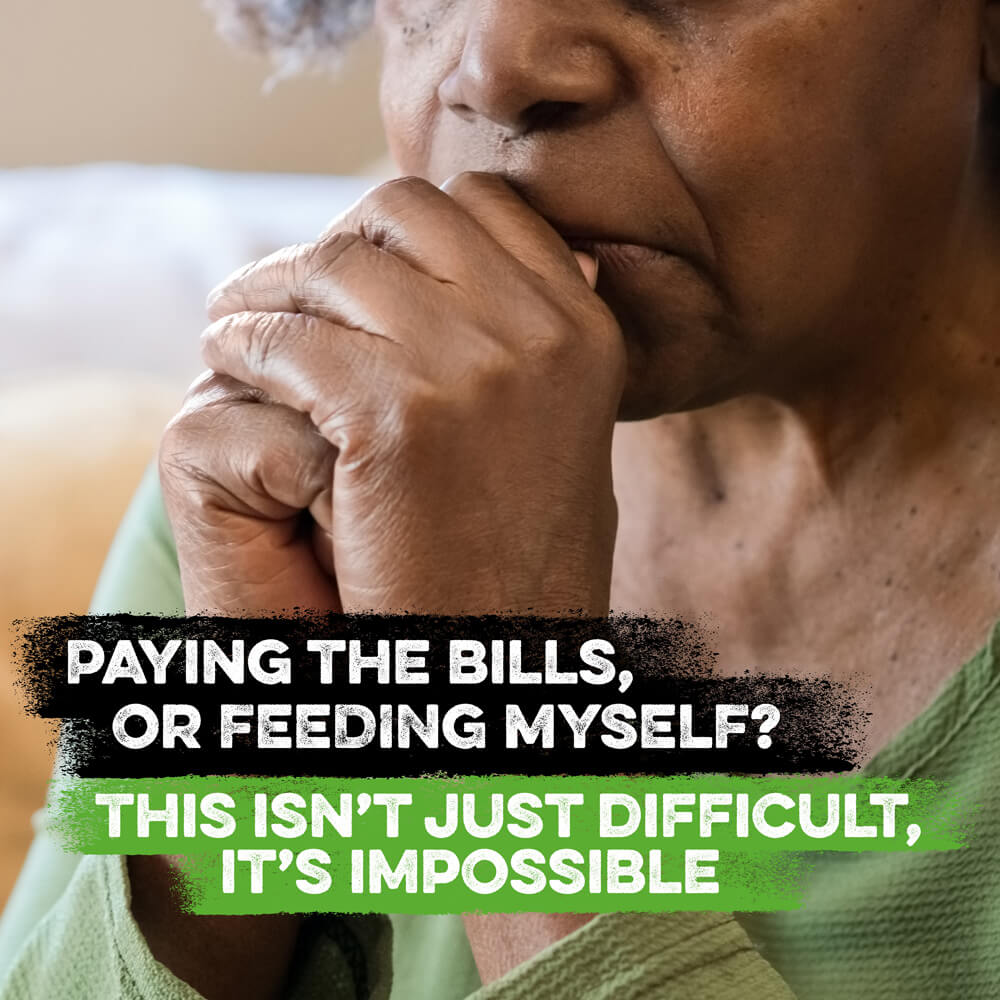

One in three (33%) people receiving Universal Credit had more than one day in the last month where they didn’t eat at all or had only one meal, while one in three people (33%) surveyed have not been able to heat their home for more than four days across the last month because they couldn’t afford to.

The charity also worked with Humankind research to interview 48 people who told researchers debt forces them into a downward spiral for their finances, their family and their mental health.

Dee, 60 from Aberdeen, worked in the building sector but was made redundant and now receives Universal Credit She said:

“It’s just so disheartening to think that I’m in debt through no fault of my own. It still won’t be paid off until I’m well into my pension. It’s causing me ongoing stress to feel like I’m never getting to the end of it. It’s overwhelming and really drags me down.”

This is the true cost of the rising price of essentials for people on the lowest incomes – people already facing impossible decisions such as heating or eating, with many having to take on debt just to get by.

People said they were unable to afford to get to work or get children to school, some said they have mould growing in their home because they can’t afford the heating, some were turning off their fridges to save money and several people highlighted an imminent risk of homelessness.

This situation is only set to get worse, says the charity, with inflation set to hit at least 7% this April.

The UK government is due to increase benefit levels by just 3.1% – less than half what’s needed to even begin to make up the shortfall. This increase amounts to just a £2 a week rise, which the charity highlights as ‘dangerously insufficient’ in light of the soaring living costs people are facing.

Worryingly, this comes on top of the £20-a-week cut to Universal Credit introduced in November and a five-year freeze on benefits rates which means these payments are worth 11% less than they were a decade ago.

The charity is calling on the UK government to increase benefits by at least 7% this April as a bare minimum, to bring them in line with the true rate of inflation and help prevent pushing more and more people into debt with no way out.

Emma Revie, chief executive of the Trussell Trust, said:

“Right now, the cost of living is forcing hundreds of thousands of families across the country into a downward spiral of debt just to get by. People are telling us they’re going days with minimal food, are having to endure the cold to save money and are being forced to turn to food banks with devastating effects on people’s mental health. Social security should be protecting people from debt and food banks – not pushing them towards it.

“This isn’t right. We know the situation is only set to get worse and we cannot wait any longer.

“That’s why we are calling on the UK Government to bring benefits in line with the forecast rate of inflation as a bare minimum in the upcoming Spring Statement, to prevent thousands more people being forced into debt and through the doors of food banks. Longer term, it is vital we strengthen our social security system so it protects us all from harm and invest in local crisis support so no one needs to use a food bank to get by.”

The Trussell Trust is urging the public to write to your local MP, asking the Chancellor to take action and make social security strong enough for all of us to rely on when we need a lifeline.

ENDS

Notes to editors:

- The research is based on an online survey by YouGov of 1,506 adults (18+) currently claiming Universal Credit. People were surveyed between 24 January – 15 February 2022.

- The figures have been weighted to be representative of people claiming Universal Credit. All weighting data provided by the Trussell Trust from Stat-Xplore.

- Figures on the proportion of people falling into debt are the Trussell Trust’s own analysis of data collected by YouGov.

- Figures on the percentage of people needing support from a food bank do not include those that solely used a food bank because they couldn’t physically access food.

- Estimates of the number of people are the Trussell Trust’s own analysis. They are calculated by taking Department for Work and Pensions data from State-Xplore on the number of people aged 16+ claiming Universal Credit in Great Britain in January 2022 and data from the Department for Communities in Northern Ireland in November 2021 and multiplying by the survey results. These figures do not include children.

- Inflation figures take into account multiple forecasts of rates increasing beyond 7%.

- The total number of people aged 16+ in Great Britain claiming Universal Credit in January 2022 was 5,627,477. In Northern Ireland in November 2021 there were 132,580.

Other detailed information on question wording and results available from the Trussell Trust on request